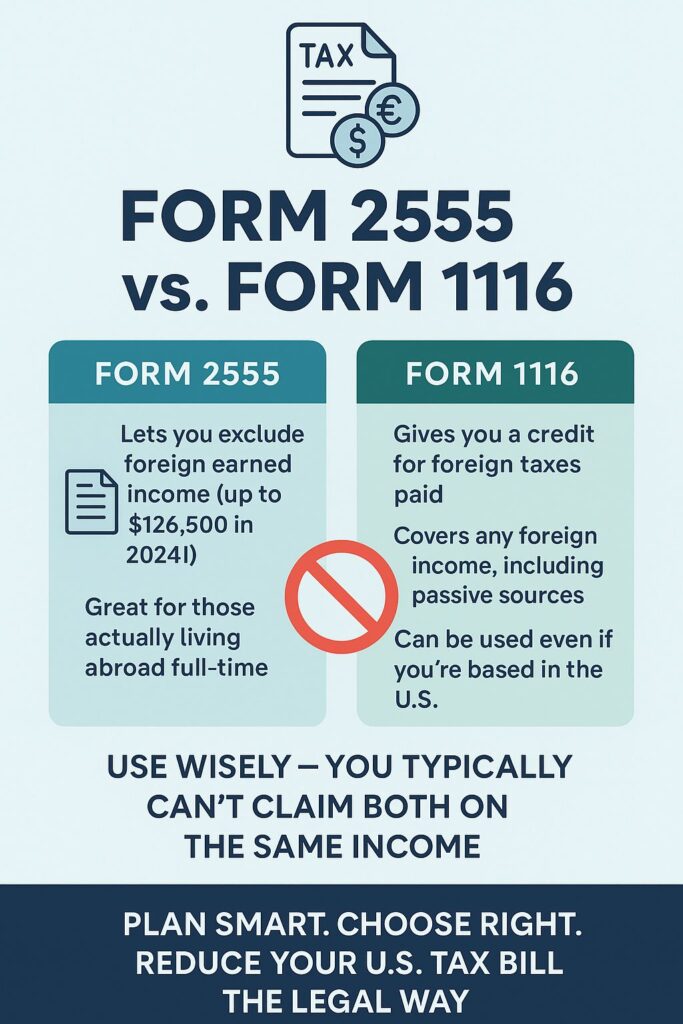

𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓 𝐯𝐬. 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔

𝐂𝐨𝐧𝐟𝐮𝐬𝐞𝐝 𝐛𝐞𝐭𝐰𝐞𝐞𝐧 𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓 𝐚𝐧𝐝 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔? 𝐇𝐞𝐫𝐞’𝐬 𝐚 𝐪𝐮𝐢𝐜𝐤 𝐛𝐫𝐞𝐚𝐤𝐝𝐨𝐰𝐧 𝐭𝐨 𝐡𝐞𝐥𝐩 𝐲𝐨𝐮 𝐜𝐡𝐨𝐨𝐬𝐞 𝐭𝐡𝐞 𝐛𝐞𝐬𝐭 𝐭𝐚𝐱-𝐬𝐚𝐯𝐢𝐧𝐠 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐰𝐡𝐞𝐧 𝐝𝐞𝐚𝐥𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐢𝐧𝐜𝐨𝐦𝐞.

📌 𝐄𝐥𝐢𝐠𝐢𝐛𝐢𝐥𝐢𝐭𝐲

🔹 Form 2555: Must 𝐥𝐢𝐯𝐞 𝐚𝐧𝐝 𝐰𝐨𝐫𝐤 𝐚𝐛𝐫𝐨𝐚𝐝 (330+ days or bona fide residence).

🔹 Form 1116: No residency needed. Just f𝐨𝐫𝐞𝐢𝐠𝐧-𝐬𝐨𝐮𝐫𝐜𝐞 𝐢𝐧𝐜𝐨𝐦𝐞 𝐚𝐧𝐝 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐭𝐚𝐱𝐞𝐬 𝐩𝐚𝐢𝐝.

📌 𝐈𝐧𝐜𝐨𝐦𝐞 𝐋𝐢𝐦𝐢𝐭𝐚𝐭𝐢𝐨𝐧

🔹 Form 2555: Excludes 𝐮𝐩 𝐭𝐨 $𝟏𝟐𝟔,𝟓𝟎𝟎 (𝟐𝟎𝟐𝟒) of earned income.

🔹 Form 1116: No cap – credit based on 𝐚𝐜𝐭𝐮𝐚𝐥 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐭𝐚𝐱𝐞𝐬 𝐩𝐚𝐢𝐝.

📌 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐈𝐧𝐜𝐨𝐦𝐞

🔹 Form 2555: Only 𝐞𝐚𝐫𝐧𝐞𝐝 𝐢𝐧𝐜𝐨𝐦𝐞 (salary, wages, self-employment).

🔹 Form 1116: 𝐀𝐥𝐥 𝐭𝐲𝐩𝐞𝐬 – including 𝐩𝐚𝐬𝐬𝐢𝐯𝐞 𝐢𝐧𝐜𝐨𝐦𝐞 (dividends, interest, royalties).

⚠️ You generally 𝐜𝐚𝐧’𝐭 𝐜𝐥𝐚𝐢𝐦 𝐛𝐨𝐭𝐡 forms for the same income – choose wisely.

📌 𝐄𝐱𝐚𝐦𝐩𝐥𝐞:

👩💼 You earn $𝟏𝟐𝟎,𝟎𝟎𝟎 𝐬𝐚𝐥𝐚𝐫𝐲 in Germany → 𝐄𝐱𝐜𝐥𝐮𝐝𝐞 𝐰𝐢𝐭𝐡 𝐅𝐨𝐫𝐦 𝟐𝟓𝟓𝟓

📈 You earn $𝟓,𝟎𝟎𝟎 𝐢𝐧 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐝𝐢𝐯𝐢𝐝𝐞𝐧𝐝𝐬→ 𝐂𝐥𝐚𝐢𝐦 𝐅𝐓𝐂 𝐨𝐧 𝐅𝐨𝐫𝐦 𝟏𝟏𝟏𝟔

✔️ This is allowed, because the income types are 𝐝𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 and 𝐧𝐨𝐭 𝐨𝐯𝐞𝐫𝐥𝐚𝐩𝐩𝐢𝐧𝐠.

❌ 𝐖𝐡𝐚𝐭’𝐬 𝐧𝐨𝐭 𝐚𝐥𝐥𝐨𝐰𝐞𝐝:

You 𝐜𝐚𝐧𝐧𝐨𝐭:

>Claim the 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐞𝐚𝐫𝐧𝐞𝐝 𝐢𝐧𝐜𝐨𝐦𝐞 𝐞𝐱𝐜𝐥𝐮𝐬𝐢𝐨𝐧 (Form 2555)

>And also take a 𝐟𝐨𝐫𝐞𝐢𝐠𝐧 𝐭𝐚𝐱 𝐜𝐫𝐞𝐝𝐢𝐭 (Form 1116) for 𝐭𝐚𝐱𝐞𝐬 𝐩𝐚𝐢𝐝 𝐨𝐧 𝐭𝐡𝐚𝐭 𝐬𝐚𝐦𝐞 𝐞𝐱𝐜𝐥𝐮𝐝𝐞𝐝 𝐢𝐧𝐜𝐨𝐦𝐞

🧠 The right form can significantly reduce your U.S. tax liability!