06a – Topic: Concept of Income – What’s Taxable Income vs. Non-Taxable Income?

Topic: Concept of Income – What’s Taxable Income vs. Non-Taxable Income?

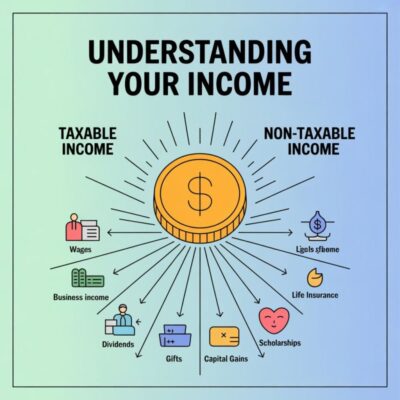

Understanding what counts as income is essential for proper tax filing in the US

🔹 1. Types of Taxable Income:-

✅ Wages, Salaries, Tips

✅ Business/Professional Income

✅ Interest & Dividends

✅ Rental Income

✅ Capital Gains

✅ Unemployment Benefits

✅ Social Security (sometimes taxable)

🔹 2. Types of Non-Taxable Income:-

❌ Life Insurance Proceeds (if due to death)

❌ Gifts & Inheritances

❌ Child Support Payments

❌ Municipal Bond Interest

❌ Certain Scholarships/Fellowships

❌ Welfare & Public Assistance

💡 Tip: Not all income is treated equally — always check IRS rules or consult a tax professional for proper classification.