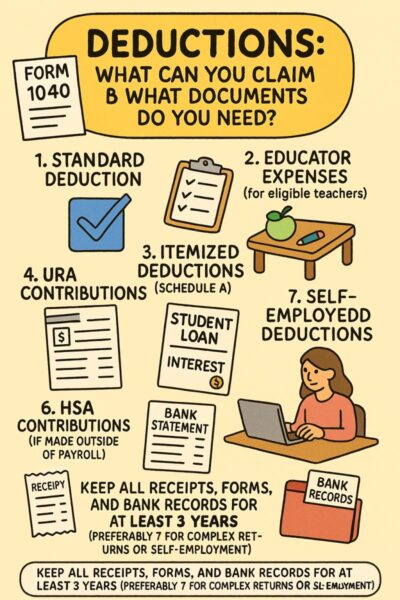

07a – Form 1040 – Deductions: What Can You Claim & What Documents Do You Need?

🧾 Form 1040 – Deductions: What Can You Claim & What Documents Do You Need?

When filing your U.S. Individual Income Tax Return (Form 1040), you may reduce your taxable income by claiming standard or itemized deductions. If you itemize, make sure to keep proper documentation in case of an IRS review.

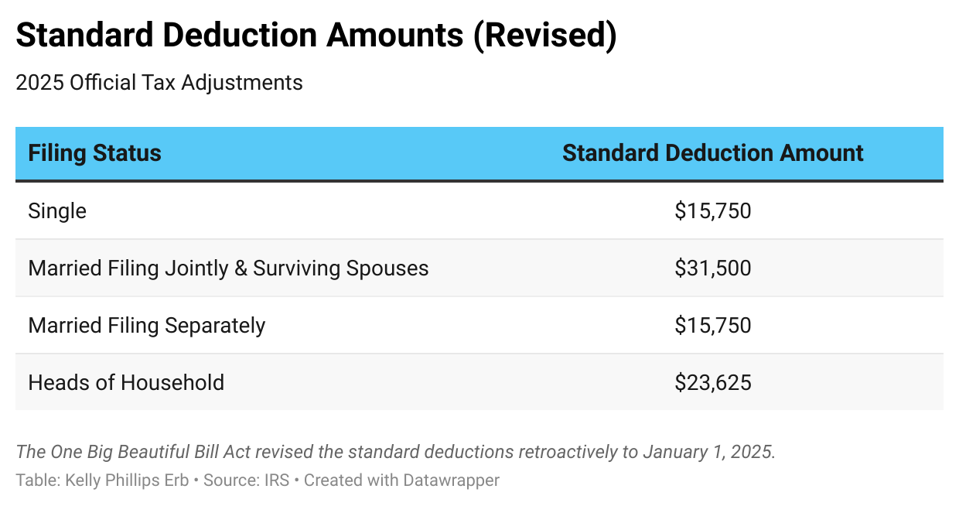

🔹 1. Standard Deduction

No documents required to claim — it’s a fixed amount based on your filing status (e.g., single, married filing jointly, etc.).

🔹 2. Itemized Deductions (Schedule A)

You’ll need proof of payment for each category:

📌 Medical & Dental Expenses

Doctor/dental bills, prescriptions

Health insurance premiums (if not pre-tax)

Mileage logs for medical travel

✅ Document: Receipts, statements, insurance EOBs

📌 State and Local Taxes (SALT)

Property tax bills

State/local income or sales tax

✅ Document: Tax bills, pay stubs, receipts

📌 Mortgage Interest

Interest on home loans

✅ Document: Form 1098 from your lender

📌 Charitable Contributions

Donations to qualified charities

✅ Document: Donation receipts, letters of acknowledgment

📌 Casualty and Theft Losses (only in federally declared disaster areas)

✅ Document: Insurance claims, repair estimates, photos

📌 Miscellaneous Deductions (very limited post-TCJA)

Gambling losses (up to winnings)

✅ Document: W-2G, logs of gambling activity

🔹 3. Educator Expenses (for eligible teachers)

Up to $300 for classroom supplies

✅ Document: Receipts, supply lists

🔹 4. Student Loan Interest

Up to $2,500 deduction

✅ Document: Form 1098-E

🔹 5. IRA Contributions (Traditional IRA, not Roth)

✅ Document: Bank/brokerage statements showing contributions

🔹 6. HSA Contributions (if made outside of payroll)

✅ Document: Form 5498-SA

🔹 7. Self-Employed Deductions

Home office, business mileage, supplies, health insurance

✅ Document: Invoices, receipts, mileage logs, insurance statements

💡 Pro Tip: Keep all receipts, forms, and bank records for at least 3 years (preferably 7 for complex returns or self-employment).