08 – Types of Individual Tax Returns & Forms

✅ Types of Individual Tax Returns & Forms

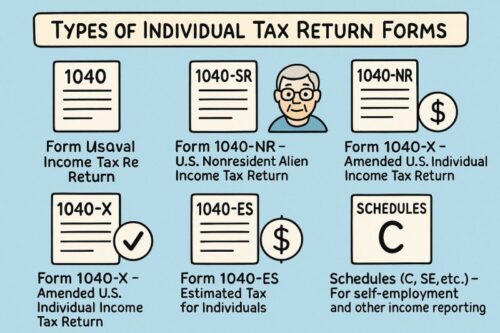

When filing U.S. federal income taxes, individuals generally use Form 1040 series. Here are the main types:

1. Form 1040 – U.S. Individual Income Tax Return

Who uses it?

Most U.S. taxpayers (residents, citizens, and some non-residents)

Purpose:

Reports income, claims deductions/credits, calculates tax/refund

Includes:

Schedules for income (Schedule 1), itemized deductions (Schedule A), business income (Schedule C), etc.

2. Form 1040-SR – U.S. Tax Return for Seniors

Who uses it?

Taxpayers 65 or older

Features:

Larger font, simplified layout

Same calculations as Form 1040

Includes standard deduction chart on first page

3. Form 1040-NR – U.S. Nonresident Alien Income Tax Return

Who uses it?

Non-resident aliens with U.S. source income (e.g., foreign students, non-resident investors)

Differences:

Cannot claim standard deduction (except India treaty exception for students), limited credits

4. Form 1040-X – Amended U.S. Individual Income Tax Return

Who uses it?

Taxpayers who need to correct a previously filed 1040

When to file:

For errors in income, credits, deductions (not for math mistakes IRS corrects automatically)

5. Form 1040-ES – Estimated Tax for Individuals

Who uses it?

Individuals who expect to owe $1,000 or more in tax after withholding (e.g., freelancers, self-employed)

Purpose:

Pay quarterly estimated taxes

6. Form 1040 Schedule C / Schedule SE

Who uses it?

Self-employed individuals

Purpose:

Report business income (Schedule C) and calculate self-employment tax (Schedule SE)

✅ State Returns:

In addition to federal forms, most states require separate individual income tax returns using their own forms.