1065 Filing Tip: Don’t Misread the “Small Partnership” Exception

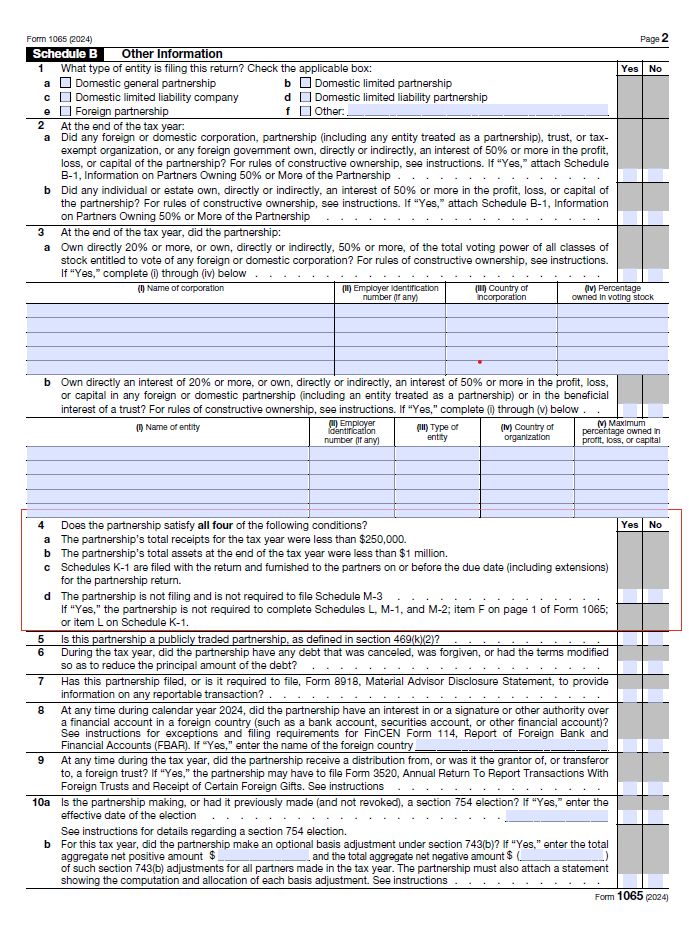

If you’re preparing partnership tax returns (Form 1065), there’s one question that trips up many preparers — Schedule B, Question 4.

This question asks whether the partnership qualifies for an exception that allows you to skip some forms (like M-1, M-2, and B-1).

Sounds simple, right? But here’s where most people get it wrong :point_down:

To answer “Yes” to this question, ALL of these must be true:

The partnership’s total receipts are less than $250,000

The assets at year-end are less than $1 million

You gave all K-1s to partners on time

The partnership isn’t required to file Schedule M-3

Here’s the common mistake:

People assume that if the partnership has exactly $250,000 in receipts or exactly $1 million in assets, they qualify.

They don’t.

The IRS uses “less than” — not “less than or equal to.”

So:

$250,000 in receipts = :x: Doesn’t qualify

$1,000,000 in assets = :x: Doesn’t qualify

If you answer “Yes” when you shouldn’t, the return may be incomplete — and the IRS could catch it.

✅Best practice: Before answering that question:

Double-check the total receipts

Look at the balance sheet totals

Confirm all K-1s were provided on time

If either threshold is met or exceeded, answer “No” — and make sure Schedules M-1 and M-2 are included.

It’s a small checkbox — but getting it wrong can lead to big compliance issues.