𝗠𝗼𝘀𝘁 𝗹𝗮𝗻𝗱𝗹𝗼𝗿𝗱𝘀 𝗺𝗶𝘀𝘀 𝘁𝗵𝗶𝘀 𝘀𝗺𝗮𝗹𝗹 𝗦𝗰𝗵𝗲𝗱𝘂𝗹𝗲 𝗘 𝗱𝗲𝘁𝗮𝗶𝗹 & 𝗶𝘁 𝗰𝗮𝗻 𝗰𝗼𝘀𝘁 𝘁𝗵𝗼𝘂𝘀𝗮𝗻𝗱𝘀

If you own rental property and report it on Schedule E, here’s something that slips under the radar for many taxpayers — and even some preparers.

On Schedule E, you don’t just enter your rental income and expenses.

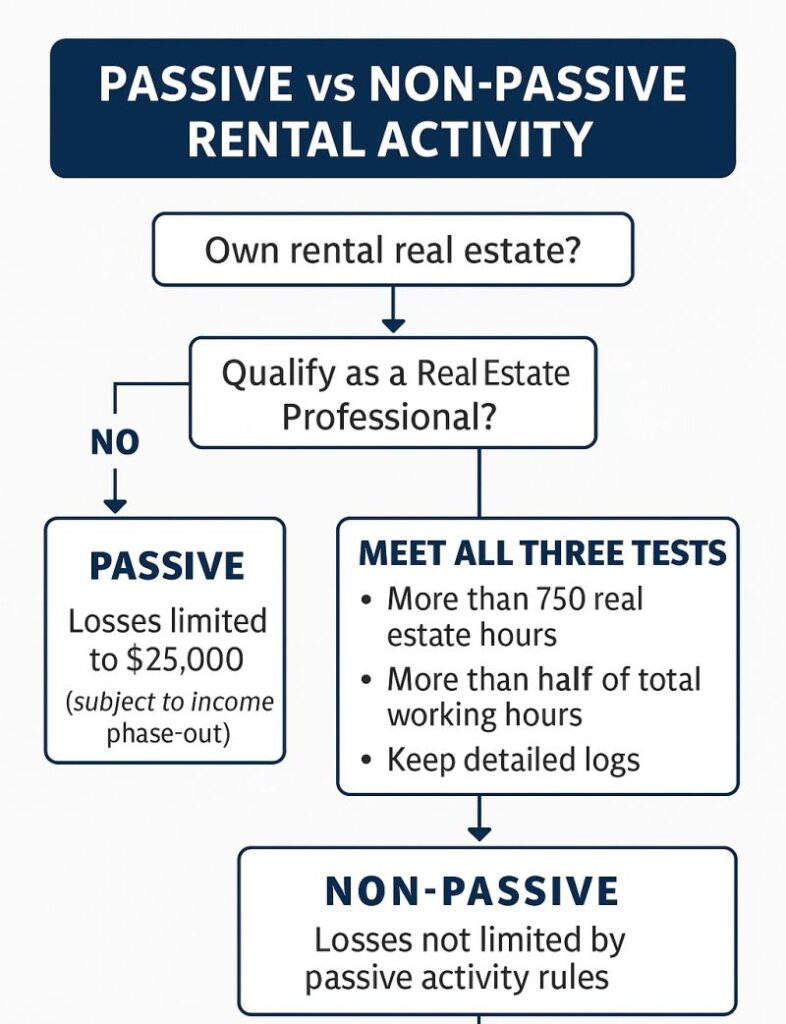

One tiny detail can change the tax impact completely: 𝘄𝗵𝗲𝘁𝗵𝗲𝗿 𝘆𝗼𝘂𝗿 𝗿𝗲𝗻𝘁𝗮𝗹 𝗮𝗰𝘁𝗶𝘃𝗶𝘁𝘆 𝗶𝘀 𝗽𝗮𝘀𝘀𝗶𝘃𝗲 𝗼𝗿 𝗻𝗼𝗻-𝗽𝗮𝘀𝘀𝗶𝘃𝗲.

𝗪𝗵𝘆 𝗶𝘁 𝗺𝗮𝘁𝘁𝗲𝗿𝘀?

• If it’s passive, your losses may be limited to $25,000 (and even that phases out as your income grows).

• If it’s non-passive, those losses could offset other types of income without the cap.

𝗛𝗲𝗿𝗲’𝘀 𝘁𝗵𝗲 𝗸𝗶𝗰𝗸𝗲𝗿 —

A rental can be non-passive if you qualify as a Real Estate Professional and materially participate.

But the IRS rules for this are strict:

• 𝗠𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝟳𝟱𝟬 𝗵𝗼𝘂𝗿𝘀 𝗼𝗳 𝗿𝗲𝗮𝗹 𝗲𝘀𝘁𝗮𝘁𝗲 𝗮𝗰𝘁𝗶𝘃𝗶𝘁𝗶𝗲𝘀 𝗶𝗻 𝘁𝗵𝗲 𝘆𝗲𝗮𝗿

• 𝗠𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗵𝗮𝗹𝗳 𝗼𝗳 𝘆𝗼𝘂𝗿 𝘁𝗼𝘁𝗮𝗹 𝘄𝗼𝗿𝗸𝗶𝗻𝗴 𝗵𝗼𝘂𝗿𝘀 𝗶𝗻 𝗿𝗲𝗮𝗹 𝗲𝘀𝘁𝗮𝘁𝗲

• 𝗞𝗲𝗲𝗽𝗶𝗻𝗴 𝗱𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗹𝗼𝗴𝘀 𝘁𝗼 𝗽𝗿𝗼𝘃𝗲 𝗶𝘁

Failing to tick the correct box or meet the test means your loss deduction could be stuck in passive activity limbo for years.

I’ve seen cases where taxpayers lost the chance to offset six figures of other income — simply because this detail wasn’t addressed.

If you have rental properties, this one checkbox on Schedule E can make all the difference.

𝗛𝗮𝘃𝗲 𝘆𝗼𝘂 𝗰𝗵𝗲𝗰𝗸𝗲𝗱 𝘆𝗼𝘂𝗿𝘀?