Notable Changes for Tax Year 2025 (Income tax returns to be filed starting tax season 2026)

💡 Notable Changes for Tax Year 2025 (Income tax returns to be filed starting tax season 2026)

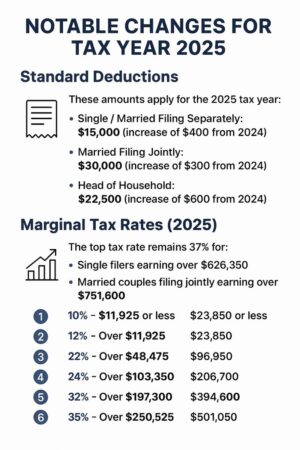

Standard deductions AND Marginal Tax rates:-

These updates apply to income tax returns filed in 2026 (for the 2025 tax year)

🧾 Standard Deductions:

*Single / Married Filing Separately: $15,000 (increase of $400 from 2024)

*Married Filing Jointly: $30,000 (increase of $800 from 2024)

*Head of Household: $22,500 (increase of $600 from 2024)

📊 Marginal Tax Rates (2025):

The top tax rate remains 37% for:

*Single filers earning over $626,350

*Married couples filing jointly earning over $751,600

Other rates and brackets:

1) 10% – $11,925 or less (single) / $23,850 or less (married joint)

2) 12% – Over $11,925 (single) / $23,850 (married joint)

3) 22% – Over $48,475 (single) / $96,950 (married joint)

4) 24% – Over $103,350 (single) / $206,700 (married joint)

5) 32% – Over $197,300 (single) / $394,600 (married joint)

6) 35% – Over $250,525 (single) / $501,050 (married joint)