Form 8938 (FATCA) – Specified Foreign Financial Assets

💡 Form 8938 (FATCA) – Specified Foreign Financial Assets :-

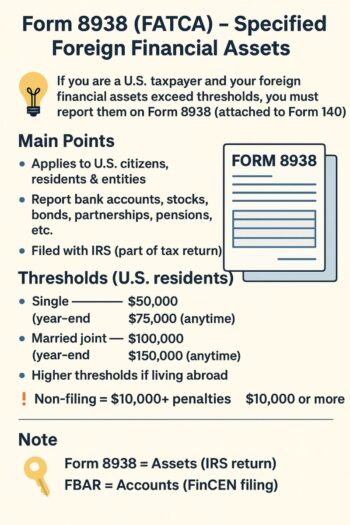

If you are a U.S. taxpayer and your foreign financial assets exceed certain thresholds, you must report them on Form 8938 (attached to your Form 1040).

📌 Main Points :-

• Applies to U.S. citizens, residents & certain entities.

• Report bank accounts, stocks, bonds, foreign partnerships, pensions, life insurance with cash value, etc.

• File with IRS (part of your income tax return).

• Thresholds (U.S. residents):

– Single: > $50,000 (year-end) / $75,000 (anytime)

– Married Filing Jointly: > $100,000 (year-end) / $150,000 (anytime)

• Higher thresholds apply if living abroad.

• Non-filing = $10,000+ penalties (can increase if not corrected).

✅ Example:

Foreign Bank A = $40,000

Foreign Stocks = $90,000

👉 Total = $130,000 → Single filer → Form 8938 required.

✨ Easy-to-remember points:

*FBAR ≠ Form 8938 → Both may apply.

*Form 8938 is about assets (attached to IRS return).

*FBAR is about accounts (filed separately with FinCEN).

🔑 Remember: Form 8938 = IRS tax compliance under FATCA, aimed at transparency of offshore wealth.