06b – Income Documents

🧾 Filing IRS Form 1040 (Individual Return) Don’t Forget These Key Supporting Documents!

While the IRS doesn’t require you to submit all documents with your Form 1040, you must keep them for your records — especially in case of an audit or income verification.

Here’s a checklist of commonly required documents based on income types:

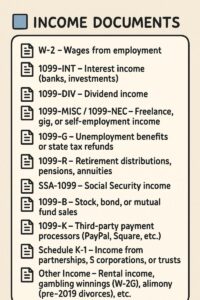

🔹 INCOME DOCUMENTS

📄 W-2 – Wages from employment

1099 series →

📄 1099-INT – Interest income (banks, investments)

📄 1099-DIV – Dividend income

📄 1099-MISC / 1099-NEC – Freelance, gig, or self-employment income

📄 1099-G – Unemployment benefits or state tax refunds

📄 1099-R – Retirement distributions, pensions, annuities

📄 SSA-1099 – Social Security income

📄 1099-B – Stock, bond, or mutual fund sales

📄 1099-K – Third-party payment processors (PayPal, Square, etc.)

📄 Schedule K-1 – Income from partnerships, S corporations, or trusts

📄 Other Income – Rental income, gambling winnings (W-2G), alimony (pre-2019 divorces), etc.

✔️ These forms flow directly into the Income section of Form 1040 — essential for tax filing.

💡 Tip: Keep digital or physical copies organized by category — this will save you time and stress later!