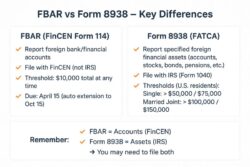

FBAR vs Form 8938 – What’s the Difference?

FBAR vs Form 8938 – What’s the Difference?

📌 FBAR (FinCEN Form 114):-

• Report foreign bank/financial accounts.

• File online with FinCEN (not IRS).

• Threshold: $10,000 total at any time in the year.

• Due: April 15 (auto extension to Oct 15).

📌 Form 8938 (FATCA):-

• Report specified foreign financial assets (bank accounts, stocks, bonds, partnerships, pensions, etc.).

• File with IRS (attached to Form 1040).

• Thresholds:

– Single: > $50,000 (year-end) / $75,000 (anytime)

– Married Joint: > $100,000 (year-end) / $150,000 (anytime).

✅ Example:

Foreign Bank = $40,000

Foreign Stocks = $90,000

👉 Total = $130,000 (Single filer)

✔ FBAR required (accounts > $10k)

✔ Form 8938 required (assets > $75k)

🔑 Remember:-

*FBAR = Accounts (FinCEN)

*Form 8938 = Assets (IRS)

➡ Sometimes you must file both.