Got Hit With a Tax Penalty Even Though You Paid? (Form 2210)

🧾 Got Hit With a Tax Penalty Even Though You Paid? Read This.

🎯 It happens more often than you’d think. You work hard, pay your taxes by year-end, and still get slapped with an IRS penalty.

Why? Because the IRS wants you to pay as you earn—not just at the end.

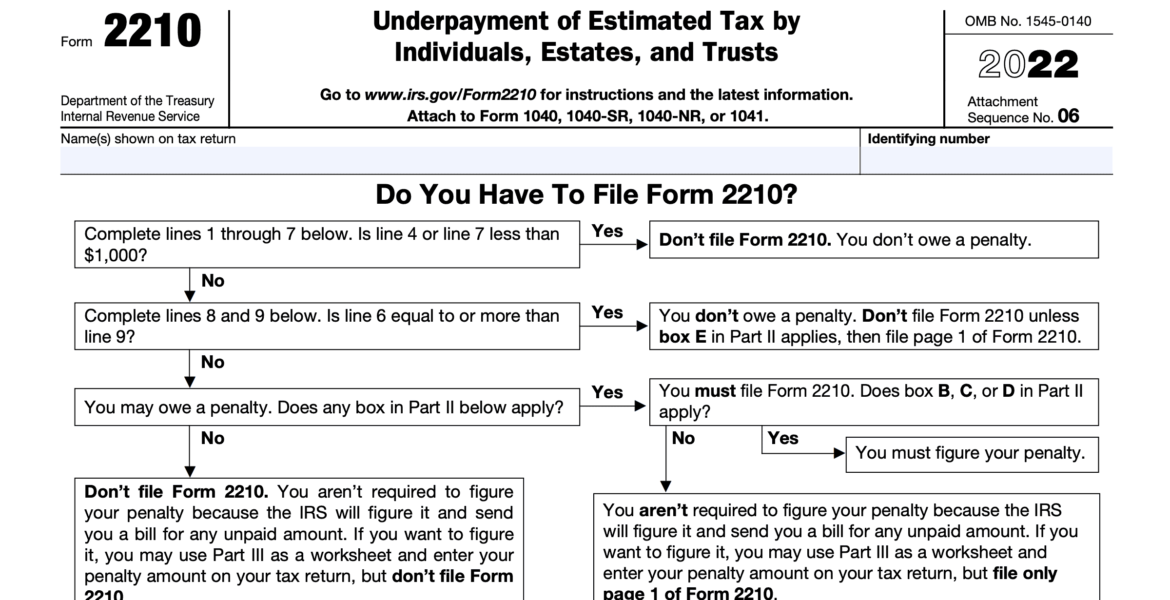

But don’t worry—Form 2210 can help you fix that.

💡 What’s Form 2210 (In Plain English)?

If you:

-

Didn’t pay enough estimated taxes throughout the year, or

-

Made most of your money later in the year

…the IRS might charge you a penalty—even if you paid everything in full by the deadline.

Form 2210 lets you explain your situation and often helps reduce or remove the penalty.

💼 Real Story:

A freelancer made $60,000 in 2024, but most of it came at the end of the year (Oct–Dec).

Here’s how his tax payments looked:

-

Q1: $300

-

Q2: $400

-

Q3: $500

-

Q4: $6,800

💥 The IRS said: “That’s too little too late. You owe a penalty.”

But a friendly tax pro showed him Part IV of Form 2210, which allows you to show the IRS when you actually earned the income.

✅ He filed it—and the IRS waived the penalty. Boom. Full refund.

💬 Real Talk:

“Paying taxes isn’t just about writing a check—it’s about telling your income story the right way.”

If your income isn’t consistent, especially as a freelancer, business owner, or gig worker—Form 2210 can save you money.

Don’t ignore it. Use it smartly. You might be surprised what the IRS will understand—if you just show them the full picture.