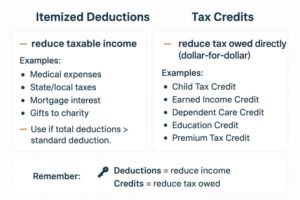

Itemized Deductions vs Tax Credits – What’s the Difference?

💡 Itemized Deductions vs Tax Credits – What’s the Difference?

📌 Itemized Deductions → reduce your taxable income:-

Examples:

• Medical expenses

• State & local taxes

• Mortgage interest

• Gifts to charity

👉 If your deductions are higher than the standard deduction then you select itemize.

📌 Tax Credits → reduce your tax liability directly (dollar-for-dollar) :-

Examples:

• Child Tax Credit

• Earned Income Credit

• Dependent Care Credit

• Education Credit

• Premium Tax Credit (health insurance)

✅ Example:

*Taxable income = $60,000

*Itemized deductions = $15,000 → lowers taxable income to $45,000

*Tax = $5,000 → apply Child Tax Credit $2,000 → final tax = $3,000

🔑 Remember:

*Deductions reduce income before tax is calculated.

*Credits reduce tax owed after calculation.