Understanding IRAs — Your Retirement Money’s Best Friend

💰 Understanding IRAs — Your Retirement Money’s Best Friend

A lot of people hear the term “IRA” and immediately think “some complicated tax thing my accountant handles.”

But really, it’s just a special account designed to help you save for retirement — with tax benefits.

Let’s break it down simply 👇

🔹 What Is an IRA?

IRA = Individual Retirement Account.

It’s not an investment itself — it’s a container where your investments (stocks, bonds, funds, etc.) grow with special tax treatment.

Think of it as:

A retirement “wrapper” that tells the IRS how your money should be taxed (or not taxed).

🧩 The Two Main Types

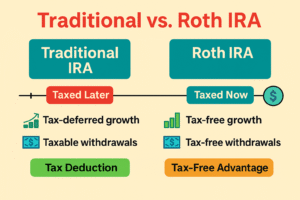

1️⃣ Traditional IRA

-

You contribute pre-tax dollars (money you haven’t paid tax on yet).

-

Your money grows tax-deferred — meaning no tax each year as it grows.

-

You pay tax when you withdraw in retirement.

-

Good for: People expecting to be in a lower tax bracket when they retire.

🧾 Tax Tip: You may get a tax deduction for contributions (subject to income limits).

2️⃣ Roth IRA

-

You contribute after-tax dollars (money you’ve already paid tax on).

-

Your money grows tax-free.

-

You withdraw it tax-free in retirement (if rules are met).

-

Good for: People expecting to be in a higher tax bracket later or wanting tax-free income in retirement.

✨ Biggest advantage: Tax-free growth forever — no tax when you take it out (after age 59½ and 5 years).

⚖️ Quick Comparison

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contributions | Pre-tax (may be deductible) | After-tax (no deduction) |

| Growth | Tax-deferred | Tax-free |

| Withdrawals | Taxable | Tax-free (qualified) |

| Best for | Lower taxes later | Higher taxes later |

| Age limit | Contribute until 70½ (if working) | No age limit (if income eligible) |

💡 Bonus: SEP IRA & SIMPLE IRA

For business owners or freelancers, these versions allow bigger contributions:

-

SEP IRA: Great for self-employed; higher limits, flexible.

-

SIMPLE IRA: For small businesses; employer and employee contributions allowed.

🚫 Early Withdrawal Rule

Taking money out before age 59½ usually triggers a 10% penalty + tax,

unless you qualify for exceptions (like first-time home purchase, education expenses, or disability).

📘 Real Talk

You don’t have to be rich to open an IRA.

Even small, consistent contributions can turn into a significant retirement fund thanks to compound growth and tax advantages.

The earlier you start, the more your money works — not the IRS. 💪