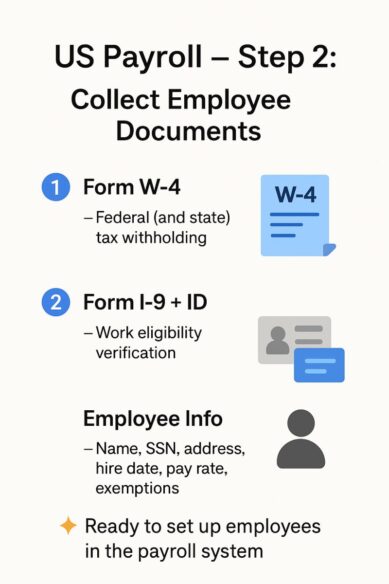

US Payroll – Step 2: Collect Employee Documents

💼US Payroll – Step 2: Collect Employee Documents :-

1️⃣ Form W-4 – Federal tax withholding Confirmation from Employee, (plus state forms if required).

👉 Example: This tells you how much tax to deduct from paychecks.

2️⃣ Form I-9 + ID – To verify work eligibility in the US.

👉 Example: Passport, or Driver’s License + Social Security Card.

3️⃣ Employee Info – Name, SSN, address, hire date, pay rate, exemptions.

✨ With these basics information you can now set up employees in your payroll system.