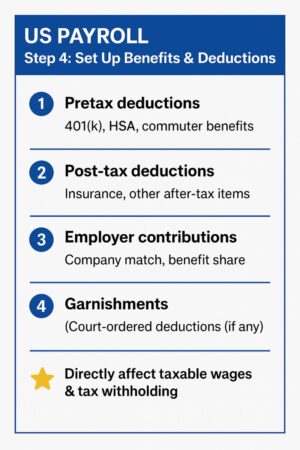

US Payroll – Step 4: Set Up Benefits & Deductions

💼US Payroll – Step 4: Set Up Benefits & Deductions :-

1️⃣ Pre-tax deductions – 401(k), HSA, commuter benefits

👉 Example: Employee puts $200/month into 401(k) before taxes.

2️⃣ Post-tax deductions – Insurance, other after-tax items

👉 Example: $50/month for optional life insurance.

3️⃣ Employer contributions – Company match, benefit share

👉 Example: Employer matches 3% in 401(k).

4️⃣ Garnishments – Court-ordered deductions (if any)

👉 Example: Child support payment withheld.

👉 These payroll posts are not just for HR or Payroll preparer — they help you understand taxes too. Payroll connects directly to W-2 and when filing Form 1040, the figures come from W-2. So don’t ignore — payroll and tax returns go hand in hand!