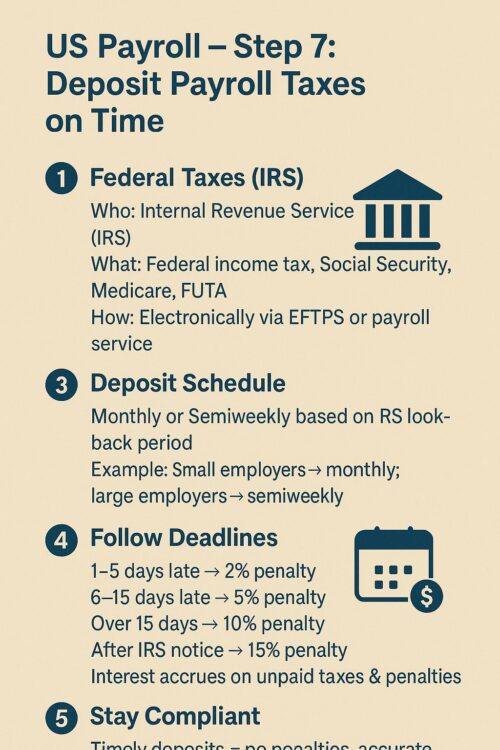

US Payroll – Step 7: Deposit Payroll Taxes on Time (to Federal Taxes (IRS) / State Taxes (State Agencies)

💼US Payroll – Payroll Tax Deposits :-

1️⃣ Federal Taxes (IRS):

*Who: Internal Revenue Service (IRS)

*What: Federal income tax withholding, Social Security, Medicare, FUTA

*How: Electronically via EFTPS (Electronic Federal Tax Payment System) or through payroll service

2️⃣ State Taxes (State Agencies):

*Who: Your state’s Department of Revenue or equivalent

*What: State income tax withholding, State Unemployment Tax (SUTA)

*How: Via the state’s online portal or approved electronic system

💡 Tip: Always check state-specific rules — each state has its own deposit schedule and payment methods

1️⃣ Know Your Deposit Schedule –

Decide if you’re a monthly or semi-weekly depositor (based on your IRS lookback period).

👉 Example: Small employers usually deposit monthly; large ones, semi-weekly.

2️⃣ Deposit Electronically –

Use EFTPS (Electronic Federal Tax Payment System) or your payroll software to make payments securely.

3️⃣ Follow Strict Deadlines –

IRS penalties apply for late deposits:

1) 1–5 days late → 2% penalty

2) 6–15 days late → 5% penalty

3) Over 15 days late → 10% penalty

After IRS notice → 15% penalty

💡 Interest accrues on both unpaid tax and penalties until fully paid.

4️⃣ Stay Compliant –

Timely deposits = no penalties, no stress, and clean payroll records!

👉 Stay connected for daily insights on US taxation.