Why choose an S-Corp over a standard LLC?

A regular LLC is simple to operate — but here’s the catch:

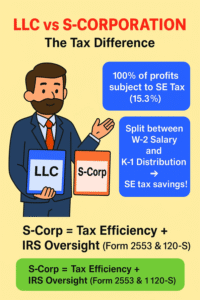

➡️ The entire profit is usually subject to Self-Employment (SE) tax.

💼 S-Corporation Highlights

✅ Reduces SE tax burden

✅ Files Form 2553 to elect pass-through treatment

✅ Avoids double taxation (no corporate-level tax)

⚖️ The Key Difference

-

Salary (W-2): “Reasonable compensation” paid to the owner — subject to payroll/FICA taxes.

-

Distributions (K-1): Remaining profit — not subject to SE tax.

💡 Example

A solo consultant earns $150,000 in net profit:

Scenario 1 – Standard LLC/Sole Prop

→ Entire $150,000 × 15.3% SE tax = $22,950

Scenario 2 – S-Corporation

→ Pays themselves $80,000 salary (W-2)

→ Takes $70,000 as distribution (K-1)

→ FICA on salary = $12,240

💰 S-Corp saves over $10,000 in FICA taxes.

⚠️ Important: Reasonable Compensation

If you underpay yourself (say, $10K salary + $140K distribution), the IRS can reclassify part of that distribution as salary — leading to back taxes, interest, and penalties.

A “reasonable” salary is what your business would pay an unrelated employee for the same role.

✅ Advantages

-

Significant tax savings on distributions

-

Limited liability protection (same as LLC)

❌ Disadvantages

-

Payroll setup required

-

Quarterly filings (Form 941)

-

Owner must receive W-2

-

Must file Form 1120-S

-

IRS scrutiny of “reasonable compensation”

❓ Common Question:

Q: An S-Corporation can only have certain types of shareholders.

What is the maximum number of shareholders an S-Corp is allowed to have?

A: The IRS allows up to 100 shareholders — and all must generally be U.S. citizens or resident individuals.

(S-Corps cannot have partnerships, corporations, or nonresident aliens as shareholders.)

Bottom Line:

S-Corp status can be a smart tax move for profitable small businesses —

but it comes with extra admin responsibilities and IRS compliance.